As the COVID 19 pandemic continues to ravage the world economy, different governments have taken different measures to aid their citizens. Here in the United States, the federal government passed a raft of measures, key among them sending stimulus checks to deserving individuals to help cushion them against the effects of the pandemic. These added a layer of complexity to your tax returns filing as it comes with a host of other documents and vocabularies such as the IRS Notice 1444.

What does a Notice 1444 from the IRS mean?

Did you receive any of the three Economic Impact Payments (aka stimulus money)? If you did, then you probably received a letter from the IRS confirming the amount sent to you. This is what is officially referred to as “Notice 1444” by the IRS. This notice is from the IRS and therefore looks more like a letter than the traditional IRS notices you are accustomed to.

The IRS mailed all recipients of the coronavirus stimulus checks a copy of their Notice 1444. This was done within 15 days after the Stimulus checks were sent out for the first payments, while the second and third took a little longer as the law gave the IRS more time to send the Notices out. This IRS notice provides you with important information such as the amount you received, how the money was sent to you, and information on how to report any amount not received.

Notice 1444 was sent to the recipients’ address on IRS records. This means that if you changed addresses before your IRS letter arrived you should check at your last address.

If you are unable to trace your Notice 1444 for the same reason, then you should check your IRS accounts transcripts you will find the information there.

Remember, Notice 1444 is only an informational letter letting you know the amount that was sent to you and by what means. You are not required to respond to it. Once you receive your Notice 1444 file it safely with your other tax returns filing records as recommended by the IRS.

Types of IRS Notice 1444

Did you receive more than one IRS letter confirming your economic impact payments? If this is the case, then you probably received more than one payment. The government sent out three different economic impact payments. For each payment, the government also sent out a notice 1444 to all the recipients. These notices are as follows:

IRS Notice 1444

This is the notice the IRS mailed recipients of the first economic impact payment made in 2020. This notice was sent out within 15 days after the checks were mailed to recipients. If the IRS made corrections to your payment or you received more than one payment during this round, then you probably also received more than one notice 1444 during this round. This should not worry you as the notice was sent out with each payment and was designed to give you information regarding the payment made.

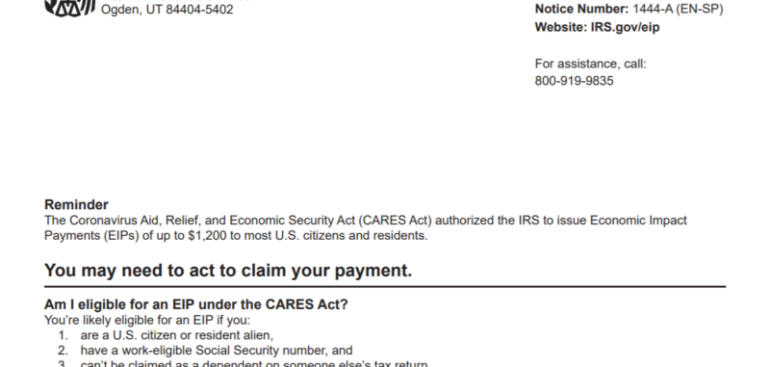

IRS Notice 1444-A

This notice was sent out to individuals who legally do not file federal income tax returns but may have qualified for the first stimulus payments. If you received this notice, then you were required to claim your payment as it was not sent out with the rest. The stimulus payments were designed to help Americans in need during the pandemic, so this means that even though you may legally be exempted from filing tax returns you still could qualify for the payments. For these reasons, the IRS made sure that every qualified American was made aware of the payment by sending the Notice 1444-A.

IRS Notice 1444-B

This IRS notice was sent out by the IRS to confirm the payment of the second stimulus checks. If you received an economic impact check during the second round of payment, then you also received this notice. It contained the same information as the other 1444 Notices only that it was sent for during the second round of payment. This notice was also sent out much later than the first one as the law authorizing the payments gave the IRS more time to process the Notices. This notice was only sent to those who were considered for the second round of pandemic payments. If you did not receive the second stimulus payments, then you should not expect this notice.

IRS Notice 1444-C

This Notice is for the third economic impact payment made in 2021. While this notice contains the same information as the others, it is important to remember that it was made in a different fiscal year.

You should to hold onto this notice and keep it with the rest of your 2021 tax returns filing records. If you file returns, you have already used the information on the first two for filing your 2020 returns, however, you are yet to file your 2021 returns. This makes keeping this notice safe even more important as the IRS can change rules for filing returns as it often does.

Why is the IRS Notice 1444 Important?

The IRS Notice 1444 was mailed to you and other recipients of the stimulus payments to serve two main purposes: To confirm all the details of the payment made to you and as a security to ensure that you know the payment was sent your way.

This means that if you received both your stimulus check and your IRS letter you should review the notice to confirm that the details are the same as the stimulus check received. This is important not just for filing your returns but also to make claims if there are errors in your payment.

Some people reported that they did not receive their stimulus payment. This could be because either the stimulus check was stolen, or money was sent to the wrong bank accounts. So, if you received a notice but not the money, then you should contact the IRS for help. The notice has a number to call in case of such a problem. In case you received the payment but did not get your notice then you can get all the information on the notice on the IRS website.

The third importance of the IRS Notice 1444 is tax preparation. The pandemic impact payments were made based on the 2019 tax returns for most people and some of their 2018 tax returns. What this means is that your income levels, number of dependents, and filing status could have changed significantly in 2020 meaning that you received less money than you would have received.

For example, take consider Jacky and Phil who got married in December 2018. In 2019 they had an adjustable gross income of less than $150,000 and they had no children at the time. Based on this information on their 2019 tax returns the IRS sends them a stimulus check of $2400. But in 2020 they had a baby. When doing their 2020 returns they discovered that they should have received $2900 ($2400+$500) as they had a new dependent that was not captured in IRS records. They can now claim the $500 as a recovery rebate credit on their 2020 tax returns.

As you can see the Notice 1444 you received is very important especially if for one reason or the other you feel that you received less money than you should have. It is an important document to use when claiming the missing amount from the IRS.

Keeping this notice for filing federal income tax returns is thus very important.

What if you did not receive an IRS Notice 1444?

The IRS Notice 1444 is designed to help you verify the stimulus payment amount that was sent to you.

This means that all is not lost if for one reason or the other you did not get your Notice 1444 or somehow you lost yours. You can still get the information on the IRS website. Simply follow these steps:

- Go to the IRS website which is found at www.irs.gov.

- Log into your account.

- Find and click the Tax Record tab.

- Follow the onscreen steps to request your latest tax transcripts. This will contain your stimulus payment information.

Remember that for your federal income tax returns filing you must have all the records of the income you received. It is therefore important to make sure that you confirm that you received all the money that is due to you and all the related documentation. In a few cases, some individuals received neither their stimulus payment checks nor their IRS Notice 1444.

If you feel that you qualified for the stimulus checks but received nothing, then make sure to check your IRS tax transcripts for any information regarding the payments. In addition, if you have any questions regarding the stimulus payment or your IRS Notice 1444 remember to contact the IRS. It pays to be proactive when handling your federal income tax returns records and information because failure to find out important information can result in tax audits and expensive tax penalties.