Everybody out there has heard an advertisement on the radio while driving or on TV late at night for the IRS programs where you can settle for pennies on the dollar or get forgiveness of your tax debt. The program that they are referring to is called the Offer in Compromise. This is a program where you can see a reduction in the tax debt, sometimes a substantial reduction.

But what is an Offer in Compromise, how does it work, and is it a good option for you?

What is an Offer in Compromise?

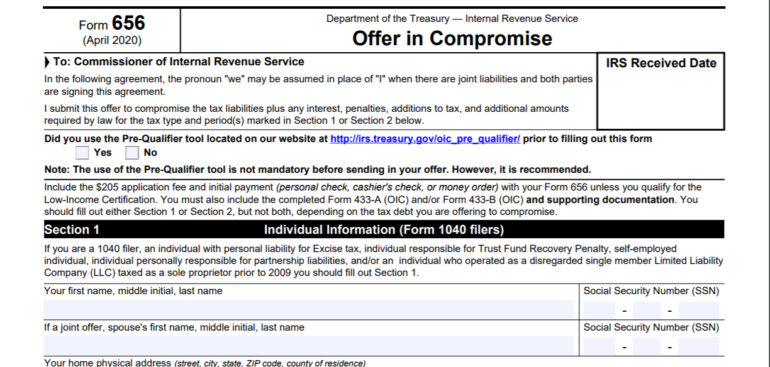

The actual definition from IRS.gov is an offer in compromise is an agreement between a taxpayer and the Internal Revenue Service that settles the taxpayer’s liability for less than the amount owed. Obviously, this is a great program, but it does not mean that everybody can settle their debt for less just because the program exists.

Taxpayers who can pay the tax debt in full or can pay the tax debt through an installment agreement typically wouldn’t qualify for the Offer in Compromise (OIC).

To qualify, a taxpayer must be compliant in terms of filing requirements. This means all required years with income have been filed up to date. Also, they must have proper withholdings or estimated payments set up for the current tax year. If the debt is business tax debt, the business must have made all required federal tax deposits for the current quarter.

How Does the IRS Decide Whether to Accept or Reject an Offer in Compromise?

The IRS bases its decision for an Offer in Compromise on a taxpayer’s “RCP”, or “reasonable collection potential”. The reasonable collection potential is how the IRS measures the taxpayer’s ability to pay. The RCP includes the value of the taxpayers’ assets such as real estate property, automobiles, bank accounts, and other property. In addition to the property, the RCP also includes future income less certain amounts allowed for basic living.

So in short, the person who qualifies for the Offer in Compromise truly cannot pay the tax debt back and does not have assets more valuable to the debt.

One major right that a taxpayer has is the right to pay their allowable monthly expenses. If you are somebody who is paycheck to paycheck and could not afford the amount required for an installment agreement, then you may qualify for the Offer in Compromise. This is the main reason the IRS would accept a compromise on the debt. The IRS officially calls it “doubt as to collectability”.

The second reason the IRS may accept a compromise is “doubt as to liability”. This is when there is a valid dispute over the existence or the amount of the tax debt.

The third reason the IRS may accept a compromise is called “effective tax administration”. This is when there is no doubt that the tax is legally owed and that the full amount could be collected but requiring a payment would create an economic hardship or would be unfair and inequitable because of exceptional circumstances.

How is an Offer in Compromise Paid?

There are two types of ways to pay an Offer in Compromise: as a lump sum or in installment payments. A lump sum is defined as an offer payable in five or fewer payments over five months. To apply for a lump sum offer, the taxpayer must submit a 20% nonrefundable deposit with the application. If the IRS rejects the offer, the 20 percent payment is not returned but applied to the full balance of the tax liability.

The second type of offer is called a “periodic payment offer.” This consists of an offer paid over 6 or more monthly installments within 24 months of when the offer is accepted.

When applying for the Offer in Compromise it is especially important to know the ins & outs of the program before applying. Especially with the fact that a 20% non-refundable deposit must be included with the offer, it is important to have somebody who knows these programs. There is nobody better to help you with this than a federally licensed IRS Enrolled Agent.

Typically, an enrolled agent will have worked for the IRS or at least have demonstrated knowledge equivalent to such a level through testing. This knowledge of what the IRS is looking for is especially important not only in the prequalification process, making sure that it is worth applying for, but also in the presentation of the financial situation to get you approved.

Drawbacks to Applying for an Offer in Compromise

There are some drawbacks to applying for the OIC in terms of collection law. During the period while the IRS is determining whether to accept or deny your offer there is a hold on collection activities. Since there is a hold on collections, there is also an extension on the legal assessment and collection period for the tax debt.

Also, during that time a Federal Tax Lien may be filed on your person or properties. It is so important to know these things and consult with a true tax professional before applying. A good example of why is if you are planning to sell a property and hope to settle your tax debt before selling since a federal tax lien will remain in place for some time even after the Offer in Compromise is paid in full.

Also, many other avenues and hardship programs can have better results than the Offer in Compromise that are based on your ability to pay and make good use of the tax debt statute of limitations. If you apply for the Offer in Compromise, it puts that statute on hold and gives the IRS longer to collect against you. With a tax professional doing an investigation of your situation, a strategy can be laid from start to finish with a way to get you out of as much of the debt as quickly as possible using all these different rules to your benefit.

Should You Deal With the IRS Directly?

While you certainly can deal directly with the IRS, the following is a great example of why it may not always be wise to do so. A client that I helped last year had been trying to work with the IRS for several years on settling a $100,000 tax debt he owed. He felt he had rights to the Offer in Compromise and had applied for it 3 different times over the course of a 5-year period. He had also tried many payment arrangements with the IRS over a period of about 5 more years but was never able to afford them. This gentleman was just on social security income with a small pension and could not afford to pay his tax debt balance. While this is a major contributing factor for qualification with the IRS for the OIC, other factors do go into as well.

The reason he was repeatedly denied was because he owned a home. He finally reached out to us for help and while we could certainly step in and give him an end date to all of this, it wasn’t an end date as soon as it could have been if he had contacted us sooner.

By showing his inability to pay, we were able to get him into smaller payments on the tax debt. With this partial pay arrangement, he will only have to make a small monthly payment until the debt expires after the 10-year statute of limitations. Due to applying for the Offer in Compromise so many times, the statute date had been extended by a little over 3 years which unfortunately added to the payment term for these small payments.

Sad to say, he always qualified for this partial payment arrangement and had forked over thousands of dollars that he could not afford as he struggled with the payment arrangements the IRS had offered him. While he was extremely happy that we could step in and save him so much money and finally give him an end date to his tax debt and payments, we both agreed that we wished we had spoken years ago and saved him the money and the aggravation of trying to deal with this on his own.

Beware of Offer in Compromise Scams

Unfortunately, in every industry, when someone is in a vulnerable situation, you have companies that prey on them. Some companies operate what the IRS calls “Offer in Compromise Mills”. These are companies that will get you on the phone with a salesperson and right off the bat he or she will make promises of settlements pennies on the dollar without really knowing anything about your situation.

The only way to know if one could qualify for the Offer in Compromise is by doing not only a careful full review of one’s financial situation but also accessing IRS records before ever relaying to clients what the possible outcomes could be. While the OIC is real and it’s a great provision, not everybody qualifies for it.

Fortunately, in this day and age of the internet, if you investigate these companies through Google or research their BBB ratings, it will quickly become clear if they’re a company you should stay away from. The good thing is that there are many honest and ethical tax relief companies that will look out for your interests first.

What If You Don’t Qualify?

In conclusion, the Offer in Compromise is a great program if you can qualify for it. And like everything else in life, you can certainly try it on your own. But if this is not something that you have studied or done hundreds of times, it would probably financially benefit you to seek representation when dealing with the IRS.

As mentioned earlier, even if you do not qualify for the miracle cure of the Offer in Compromise there are many other tax relief programs available that can at least limit your exposure to the tax debt. With these programs, you may not see the steep reduction that you had hoped for but at least you won’t significantly overpay on the tax debt with penalties, fees, and interest.