Over my many years in this industry, I have encountered petrified taxpayers that reach out looking for help that feels the IRS is bearing down on them. This is what the IRS does, so in some cases, it is 100% valid to be scared.

With others that contact me, I ask some simple questions and come to realize that they have been the victim of an IRS scammer. In any situation when people are vulnerable you will always have nefarious people in our society trying to take advantage.

Thousands of people fall victim to these scammers every year. An FTC (Federal Trade Commission) report said that these scams have cost Americans some $667 million in 2016.

In today’s article, I am going to discuss things to look out for when you feel you are communicating with the IRS to avoid falling victim to these scammers. I will go on to provide and describe some of the most common scams to look out for from people calling and posing as the IRS all the way to companies in our industry who scam taxpayers in need of help.

The IRS has provided a list they call “the dirty dozen”. The dirty dozen list focus’ on scams that target taxpayers. The IRS urges everyone to be on guard and look out for others. Taxpayers should all be aware of these different scams and know that they are legally responsible for what is put on their tax returns even if it is prepared by someone else.

Make sure when hiring a tax professional to look at their online reviews to see what previous clients have said about them and to make sure they have the correct licensing and educational background to properly help you. An Enrolled Agent and CPA (certified public accountant) are true tax professionals that can assist you.

The Dirty Dozen IRS Scams

Phishing

Scammers utilize fake emails or websites looking to steal personal information. The IRS will never initiate contact with taxpayers through email about a tax bill, refund, or Economic Impact Payments. The IRS Criminal Investigations has seen a tremendous increase in phishing activity utilizing emails, letters, texts, and links. These schemes are blasted to large numbers of people to get personally identifying information or financial account information including account numbers and passwords.

Fake Charities

Criminals Frequently exploit natural disasters and other situations such as the current Covid-19 pandemic by setting up fake charities to steal from well-intentioned people trying to help in times of need. These schemes can start with a contact by telephone, text, social media, or in-person using a variety of tactics. They try to trick people into sending money or personal financial information. Legitimate charities will always be willing to provide their EIN (Employer Identification Number) which can be used to verify their legitimacy. You can search these directly on the IRS website.

Threatening Impersonator Phone Calls

Scammers will call taxpayers posing as the IRS. They can threaten arrest, deportation, or license revocation if the person does not pay a bogus tax bill. These callers will often use robocalls which are text to speech recorded messages with instructions for returning the call. The IRS will never demand immediate payment, threaten, or ask for financial information over the phone or call about an unexpected refund or Economic Impact Payment.

Social Media Scams

Social media scams have also led to tax-related identity theft. The basic element of social media scams is convincing a potential victim that he or she is dealing with a person close to them that they trust via email text or social media messaging.

EIP or Refund Theft

Scammers will steal identity information and then file false tax returns or supply bogus information to the IRS to divert refunds to wrong addresses or bank accounts.

Senior Fraud

Seniors are more likely to be targeted and victimized by scammers than other segments of society. The IRS recognizes the pervasiveness of fraud targeting older Americans.

Scams Targeting Non-English Speakers

IRS impersonators and other scammers also target groups with limited English proficiency. These scams are often threatening in nature. Some scams also target those potentially receiving an Economic Impact Payment and request personal or financial information from the taxpayer.

Unscrupulous Tax Preparers

Dishonest tax preparers pop up every tax season committing fraud, harming innocent taxpayers, or talking taxpayers into doing illegal things that they regret later. Taxpayers should avoid what the IRS calls “ghost preparers”. This is where a tax preparer will not sign a tax return.

All paid tax preparers must have a PTIN (Preparer Tax Identification Number) and must sign and include this PTIN on all returns. These types of preparers will promise inflated refunds by claiming fake tax credits, including education credits, the Earned Income Credit, and others.

Taxpayers should avoid preparers who ask them to sign a blank return, promise a big refund before looking at the taxpayers’ records, or charge fees based on a percentage of the refund.

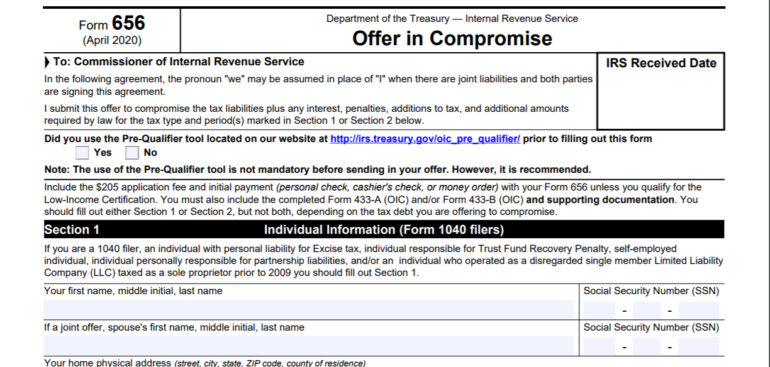

Offer in Compromise Mills

While there are many good tax relief companies out their anytime you have people in vulnerable situations you will have companies that prey on that. There is an extremely attractive IRS Program called the OIC (Offer In Compromise). This is where the IRS settles, takes a lesser amount, and forgives the remainder of the tax debt. This is a difficult program to qualify for.

These unscrupulous companies oversell the program to unqualified candidates so they can collect hefty fees from taxpayers already struggling with debt. These companies will cast a wide net for taxpayers and charge them pricey fees and churn out applications for the program that they are unlikely to qualify for.

Fake Payments with Repayment Demands

A new method that scammers are tricking taxpayers with has emerged since the IRS has taken measures to crack down on identity theft. In the past scammers would steal a taxpayer’s personal information such as social security number and bank account information and then file fake returns with refunds directed to the scammer. With IRS cracking down and making sure refunds are going to the correct taxpayer these scammers will now make a call once the refund is issued posing as the IRS and tell the taxpayer they need to pay the money back to them to avoid trouble. These scammers typically demand payment with specific gift cards for the amount of the refund.

Payroll and HR Scams

These scammers use phishing techniques to steal Form W-2 and other tax information from tax professionals, employers, and taxpayers. They commonly use two methods which are business email compromise or business email spoofing. This has become more common since people have been working from home due to covid and more business communication is done through email.

Ransomware

Ransomware is malware targeting human and technical weaknesses to infect a potential victim’s computer, network, or server. Once infected ransomware looks for and locks critical or sensitive data with its own encryption. Victims typically are not aware of the attack until they try to access their data, or receive a ransom request in the form of a pop-up window.

How to Avoid Falling Victim to an IRS Scam

In conclusion, the IRS very rarely if ever makes phones calls or sends emails. They definitely do not do this as an initial interaction with a taxpayer. The IRS will never call you and threaten arrest nor will they send local police to arrest you. Ordinary taxpayers are not at risk of going to jail over unpaid taxes. If you receive contact from the IRS by these methods, it is most likely fraudulent. Even if the caller ID shows IRS does not mean it is really the IRS. Unfortunately, caller IDs can be easily spoofed to say whatever a caller wants.

If the contact is initiated via email do not respond or click any of the links. Forward any of these emails to phishing@irs.gov. If you receive a phone call, tell them you are busy and will call back shortly and ask for the caller’s badge number and name. Then contact the treasury department directly by calling its fraud hotline 1-800-366-4484.

If you receive a text that claims to be from the IRS, it is a scam. The IRS does not send text messages. If you receive a text claiming to be the IRS forward it to the IRS at 202-552-1226. If you feel you have been a victim of Identification theft, then you need to complete a form 14309 Identity theft affidavit.

If you really owe taxes, then make sure you are dealing directly with the IRS or have a legitimate tax professional working on your behalf. You can check if you owe right on the IRS website.

If you feel that you want or need representation, make sure to investigate whatever company that you hire. Fortunately, with the internet, you can see through a company’s reviews how they have treated their previous clients. Also, make sure they have true tax professionals on staff who are licensed to communicate directly with the IRS on your behalf. Enrolled Agents, CPAs, and Tax Attorneys are your best choices to represent you.