With tax season usually being a challenging time for most businesses and individuals, you definitely need all the help you can get, whether you have let years of tax debt add up or are about to file complex taxes for the first time. Irrespective of your tax case, it is paramount to entrust the right tax professional, especially if you are called to cope with tax debt.

Fortunately, in this “battle”, you are not alone. In fact, you have plenty of options, with the most popular ones being tax attorneys, certified public accountants (CPAs), and enrolled agents. Although they all help taxpayers, each has a different role. The status of your case with the IRS (Internal Revenue Service), as well as your unique goals and needs, will determine which tax expert you need to partner with. Read on to figure everything out so you can make the most informed decision.

What Is a Tax Attorney and What Do They Do?

A tax attorney is a legal professional that has passed the state bar exam. They are law degree holders and specialize in tax law. Therefore, a tax attorney is the better choice if you are in trouble with tax authorities (i.e., you face levies or tax liens or owe thousands in back taxes) and need to deal with the legal aspect of tax preparation.

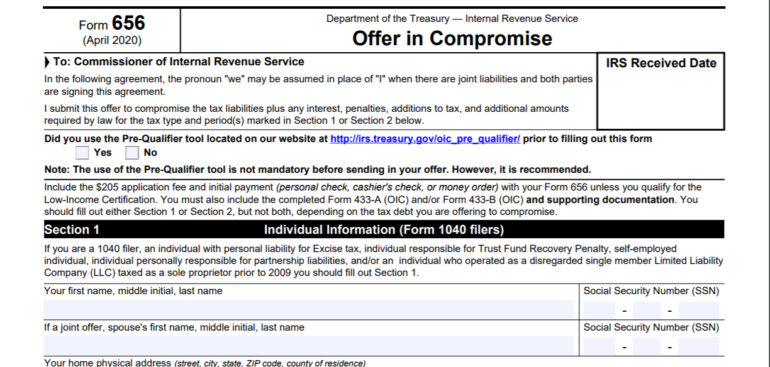

A tax attorney will represent your best interest in IRS communication, pretty much in the same way a CPA (Certified Public Accountant) and Enrolled Agent (EA) will. However, tax attorneys have undergone many years of training and education in fields like dispute resolution and tax controversy, and know not only how to represent their clients during IRS proceedings, but also how to go up against the IRS when adverse tax actions take place. Plus, they are uniquely equipped to undo property liens, halt wage garnishments, come up with compromises with the IRS, help with unfiled returns, settle back taxes, and handle all legal tax matters you might be dealing with.

Note: It is best to find a tax attorney that specializes in the specific type of tax help you need (i.e., tax attorneys with expert knowledge on estates and trusts).

What Is a CPA and What Do They Do?

A Certified Public Accountant (CPA) has:

(1) 150+ hours of education,

(2) a 5-year business degree, and

(3) passed the intensive CPA exam.*

* The CPA exam consists of four sections (1) Regulation, (2) Financial Accounting & Reporting, (3) Business Environment and Concepts, and (4) Auditing & Attestation), totaling 1,000 questions.

CPAs are more experienced and knowledgeable in tax preparation rather than a tax professional you would see for simple things. So, a CPA makes a good fit if your tax situation is complicated (i.e., you have high net worth investments, have children, are divorced, and own a business). Allowing a CPA to prepare your taxes, in such cases, is probably the best course of action you can take, especially if you have a lot of money coming in and out. Also, tasks like undergoing audits, creating a financial plan, and paying quarterly taxes are easier with a CPA, who can:

- Assist you with monthly and yearly accounting services.

- Come up with a long-term tax plan.

- Help you carry it through.

At the end of the day, a CPA will make the tax process simpler for you year after year, especially if you develop an ongoing relationship with one.

Let’s also note that a CPA is required to complete 120+ hours of continuing education every three years while the average tax preparation professional has undergone between 60-80 hours of training. Plus, CPAs know how to comply with the federal laws and still maximize benefits while minimizing your tax liability.

What Is an IRS Enrolled Agent and What Do They Do?

An IRS Enrolled Agent (EA) is a tax professional that can help you with your personal and business tax returns, except for Tax Court, where you need a tax attorney to represent you before the IRS. A registered agent knows the ins and outs of the IRS because they are required to have worked for the IRS for a minimum of 5 years.

An enrolled agent’s role is pretty similar to tax attorneys and CPAs. Back in 1913, the responsibilities of an Enrolled Agent included claims for monetary relief for taxpayers with inequitable taxes. Over the years, the sources of tax collections (i.e., gift, estate tax, income tax, etc.) became even more complex, which gave additional duties to EAs, including tax preparation and taxpayer advocacy.

Given that an IRS enrolled agent’s enrollment is a federal designation, Enrolled Agents have the right to work across state borders – something that tax attorneys and CPAs cannot do without meeting the desired state’s reciprocity requirements.

To become an IRS Enrolled Agent, one needs to pass a 3-part comprehensive IRS test* that covers business and individual tax returns. This test is significantly different from the one CPAs sit, as it is on tax law. On the other hand, the CPA exam is almost exclusively on auditing procedures and rules, as well as accounting and designed to make the interpretation of financial statements easier. This interpretation, though, does not refer to how taxes are calculated rather than how to present tax obligations in the financial statement.

Nevertheless, prior experience as an IRS employee can also earn them Enrolled Agent status. Once they become classified as IRS Enrolled Agents, they need to complete 72 hours of a continuing education course every 36 months. Finally, all IRS Enrolled Agent candidates are subject to being thrown out (disbarred) from practice before the IRS if they have been found to perform illegal acts. For that reason, background checks are performed on Enrolled Agents on a regular basis. An Enrolled Agent can also be removed from their duties if they fail to meet the continuing education requirements.

Note: IRS Enrolled Agents cannot perform all kinds of audits. According to regulations, they are not allowed to express an unqualified type of opinion (i.e., when a public company files their financial statements with the SEC – Securities & Exchange Commission). Also, EAs are not required to have prior knowledge of tax preparation. It is up to them if they will be preparing tax returns or not.

*An EAs exam consists of (1) Tax Code for Individuals, (2) Tax Code for Businesses, and (3) Representation, Practice and Procedures (100 questions each).

What’s the Difference Between a Tax Attorney, a CPA, and an Enrolled Agent?

As already mentioned above:

- Certified Public Accountants (CPAs) are accounting experts, with one of their specialties being tax matters. They are fully capable of doing basic tax returns, provided no extensive legal analysis is required.

- Enrolled Agents (EAs) are particularly skilled tax practitioners authorized by the federal government and empowered to represent their clients before the IRS. They can handle tax audits, tax appeals, tax collections, and relevant matters, and are a great option for basic W2 tax preparation.

- Tax Attorneys are law specialists who can represent in court (but not always deal with the IRS). They are the best choice if you need assistance with complex tax-related matters (i.e., you are being audited or receive an IRS notice).

All in all, your particular tax matter will help determine whether it would be best to hire a tax attorney, enrolled agent, or a certified public accountant.

Seek the assistance of a CPA if:

- You are called to figure your way through minimizing your tax liability while dealing with complex business or personal taxes.

- Need basic tax preparation.

- Want to be represented for a state or federal issue in any of the 50 states (for IRS representation and tax resolution).

- Want a qualified tax professional to handle highly complex financial statements.

- Wish to get your audited financial statements and accounts in order.

- You are NOT focused purely on taxes.

Seek the assistance of a tax attorney if:

- You are involved in a tax controversy issue or are receiving debt collection notices or are, in any way, in trouble with the IRS.

- You are a breath away from receiving a levy on your wages or bank accounts. You should be able to know this if your case has been assigned a revenue officer by the IRS. In this case, do turn to a tax lawyer to get valuable advice (and professional help) on how to protect your rights and stay out of trouble.

- You face tax fraud allegations or owe taxes. This is when you definitely need legal representation in discussions and negotiations with the IRS by a tax attorney.

- You have been contacted by the Criminal Investigation Division and are facing tax-related criminal charges, such as evasion or fraud.

Seek the assistance of an IRS Enrolled Agent if:

- You need basic tax preparation.

- Want the most cost-effective solution.

- You are not involved in a tax dispute.

- Need cross-state representation.

- Need a simple IRS status check.

- You want a tax professional for routine matters, such as miscellaneous tax filings and tax planning.

- Need representation before any administrative level of BOE, IRS, CDTFA, FTB, EDD tax agencies.

- Want a tax professional to handle issues like IRS appeals, delinquent unfiled tax returns, back tax settlements, employment 941 payroll, liens, garnishments, levies, collections, and tax audits.

So What is Innovative Tax Relief?

Most tax professionals fall into one of the three above categories. Our team at Innovative Tax Relief, however, includes all three! We are an IRS Enrolled Agent and have on staff tax attorneys and CPAs. So regardless of the tax issues you’re dealing with, we can help you.

Get in touch with us for a free consultation with one of our tax experts and start finding some relief from your tax problems today.