With the science showing indications that there is a necessity to change the way energy is provided, many people are making the change towards renewable energy.

Renewable energy is useful energy that is collected from renewable resources, which are naturally replenished on a human timescale, including carbon-neutral sources like sunlight, wind, rain, tides, waves, and geothermal. These forms of renewable energy generate energy without producing any greenhouse gas emissions from fossil fuels and reduce some types of air pollution. Also, they can help pull our country away from dependence on imported fuels.

With all this necessary benefit the government has put forth tax credits to incentivize people to utilize renewable energy and make investments into their properties to make their residences more energy efficient. These incentives are coming in the form of tax credits.

One of the most popular and the ones we will discuss further today is the Solar Tax Credit. I will start off by explaining exactly what the solar tax credit is and the benefits it provides. I will also give a little bit of the history of this credit.

What Is a Tax Credit?

A tax credit is a sum that can be subtracted from the total payable tax and offsets the overall liability. If an individual is charged more tax, then the excess tax is given as a tax credit which can be adjusted against future liabilities. So, if you owe $1000 in taxes and you qualify for a $1000 tax credit your net liability would be zero. It is an actual dollar to dollar reduction.

What is the Solar Tax Credit?

The Solar Tax Credit is also known as the investment tax credit and allows you to deduct 26% of the cost of installing a solar energy system from your federal taxes. The Solar Tax Credit was first introduced in 2005 as a 30% reimbursement credit. The credit was a part of the Energy Policy Act of 2005 during the Bush Administration. It has been extended annually since then up to 2015.

In 2015 it got a long-term extension with a dropdown. The plan dropped the credit down to 26% in 2020, 22% in 2021, and down to zero after 2021. Fortunately, new legislation signed last year would keep the credit at 26% for 2021 and 2022 then drop it to 22% in 2023. This means that you are reimbursed 26% of the actual cost of the full cost of purchasing and installing the solar power system.

Since this credit was introduced the U.S. solar industry has grown by more than 10,000% not only helping our environment but it has also helped create hundreds of thousands of jobs and investing billions in the economy in the process.

Do I Qualify for the Solar Tax Credit?

The major form of solar energy that can be installed and qualify for reimbursement through credit is solar panels. Solar energy property is recognizable for the solar array on its roof or on its grounds. They are typically black panels that are filled with solar PV &photovoltaic) cells. These cells convert sunshine into useable electricity.

The tax credit is not only good for personal taxes and residential property it can also be used on a business filing with a commercial property. If you are trying to utilize the credit on a personal tax return the property must be one that you own not one that you rent. It must be a property that you live in for at least part of the year, so vacation homes are eligible. These residences can include a house, a houseboat, condominium, cooperative, mobile home, and prefabricated homes.

Also, the solar equipment must be owned not leased. If a new homebuyer buys a newly built home with solar and owns the system outright, the homeowner would be eligible for the credit the year they move into the house.

Solar panels are not the only equipment that qualifies for the tax credit. Geothermal heat pumps, small wind turbines, fuel cell property, energy-efficient heating and air conditioning systems, water heaters, and biomass stoves also qualify. If this equipment or solar panels are used to heat a swimming pool or hot tub they do not qualify.

Rental properties that are not lived in throughout the year by a taxpayer also do not qualify. But if you live in the house part of the year and rent it while you are not there it will qualify. If you live in the house part-time you will have to reduce the credit for a vacation home or rental to reflect the time when you are not there. If you live there for 3 months of the year, then you can claim 25% of the credit.

Unfortunately, the solar tax credit is a nonrefundable credit. This means if the credit is more than the taxes owed the remainder will not be sent out as a refund as some other credits do. The credit can be carried back 1 year and forward 20 years. This means if you had a tax liability last year, but you do not have one this year you can still claim the credit.

How Do I File For The Solar Tax Credit?

To claim the solar tax credit, you must complete an IRS Form 5695 and include the result on your IRS schedule 3 on the 1040 form. This form calculates tax credits for a variety of qualified residential improvements. These steps as seen on energysage.com break down how to fill out this form.

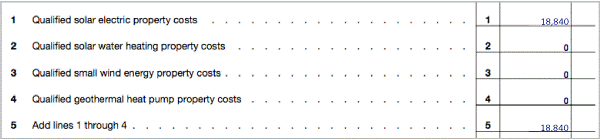

- First, you will need to know the qualified solar electric property costs. That is the total gross cost of your solar energy system after any cash rebates. Add that to line 1.

- Insert the total cost of any additional energy improvements, if any, on lines 2 through 4, and add them up on line 5.

- On line 6, multiply line 5 by 26%. This is the amount of the solar tax credit.

Note: this is from the 2019 form when the ITC was still 30%.

- Assuming you are not also receiving a tax credit for fuel cells installed on your property, and you aren’t carrying forward any credits from last year, put the value from line 6 on line 13.

Now you need to calculate if you will have enough tax liability to get the full 26% credit in one year.

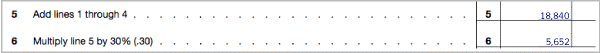

- Complete the worksheet on page 4 of the instructions for Form 5695 to calculate the limit on tax credits you can claim. If you are claiming tax credits for adoption expenses, interest on a mortgage, or buying a plug-in hybrid or electric vehicle, you will need that information here. (For this example, the total federal tax liability is $7,000.)

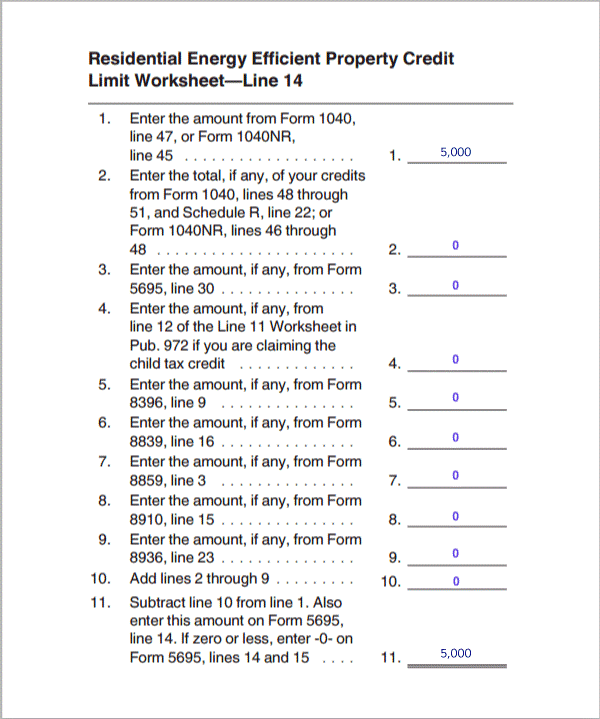

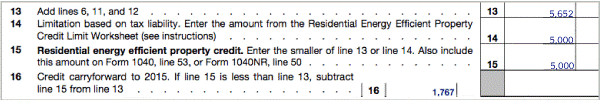

- Enter the result on line 14 of Form 5695. Review line 13 and line 14, and put the smaller of the two values on line 15.

- If your tax liability is smaller than your tax credits, subtract line 15 from line 13, and enter it on line 16. That’s the amount you can claim on next year’s taxes.

Add the credit to Schedule 3/Form 1040.

The value on line 15 is the amount that will be credited to your taxes this year. Enter that value into Schedule 3 (Form 1040 or 1040-SR), line 5, or Form 1040NR, line 50.

The steps above outline all you need to do to have 26% of the cost of your solar panel system credited back to you! If you did energy efficiency improvements to your home in the same year, you may also need to complete page 2 of Form 5695. Either way, be sure to include Form 5695 when you submit your taxes to the IRS.

In conclusion, if you are ever thinking about installing any of this equipment to make your home more energy-efficient now is the time. It seems that this credit keeps on getting extended, but it has been reduced so you never know what the future will bring. At this point, it expires in 2024.

Obviously, for some people it is just not affordable but if it is the 26% credit and the savings over time in reduced energy bills seem to make it a great investment. Currently, estimates show the average national cost to purchase and install panels on a residence is $16,860. This would result in a tax credit of $4618.

This is still an excessively big investment so the next thing to consider is the savings on energy cost. Studies show that solar panels will pay for themselves after three years. Also, some states and counties offer additional credits as well. In some areas, if your equipment produces excess electricity that you do not use it can be sold to your electric company.

Of course, one of the most important reasons to go solar is so that you can do your part for our environment. With the present administration and their push for more green energy, the credit could get better but acting now you know you will get huge savings.