There is a lot of confusion when it comes to this topic.

Most creditors cannot garnish federal benefits. This includes social security benefits. The federal government has a different set of rules than most creditors. Only the federal government can garnish your social security and other federal benefits.

Throughout my time in this industry, I have absolutely received more phone calls from people on social security being garnished than garnishments on regular income and many others in my industry will say the same.

The only explanation is that it is an easy form of garnishment because it is government to government. Another big confusion when it comes to social security is that it is nontaxable. This is true in some cases but if there is additional income then social security can become taxable.

No taxpayer regardless of additional income has all of their social security taxed.

It is either zero, 50% or 85%. If you have income between $25,000 and $34000 you may have to pay tax on up to 50% of your benefits. If you have more than $34,000 up to 85% of your benefits may be taxable.

These two confusions can lead to some major tax problems.

I have dealt with many clients that because of these confusions were being garnished 15% of their social security check when they were already living in a tight financial situation. Many of these cases call in for help and they didn’t even know that they owed a tax debt or that they were even required to file.

I can think of one client that was completely blindsided by the IRS garnishment.

She also went a good amount of time without realizing that it was happening because she never received any notice from the IRS of not only the garnishment but never received notice that she actually owed a debt. Out of respect for her privacy, we will call her Ms. J.

Ms. J was a widow whose husband had died about 8 years back. Her had handled most of the bills and had always handled the yearly tax filing. She was left with a little savings and a pension from her deceased husband. She was 76 years old so at this point in her life she was retired and just receiving social security and this pension.

Her confusion and listening to people who were not tax professionals led her to the assumption that because she was retired and on social security, she did not have to file taxes.

Over these many years as her savings was being depleted, she downgraded her rental situations a few times moving from a rented home to a cheaper senior’s apartment.

Since she had moved since the last time that her husband had filed taxes the IRS no longer had her correct address. So, years went by, and she never heard anything, so she just figured her assumptions about filing were correct.

As her savings were depleting, she was becoming more dependent on the income she was receiving from her social security and the pension. She then started noticing that her social security deposit was smaller than it had been in the past.

When she received her statement, she saw that the IRS had been taking $270 monthly out of the $1800 that she normally receives. She said she began calling them but could never get through. She said she felt helpless and gave up but after a few months of trying.

Luckily a friend of hers had been a client of ours in the past and recommended that she give us a call. We knew we could help her, but we had to get some answers for her from the IRS first.

Tax Investigation

Ms. J was very excited to finally get some answers because at this stage she had no idea how much she owed or even how she owed it.

We had a good idea of what had happened because we had seen cases like this in the past, but every case is different, so we definitely wanted to get all of her information from the IRS and strategize using the facts. Within about a week we had all of her information from the IRS.

The IRS had been up to a lot in the background that she was unaware of.

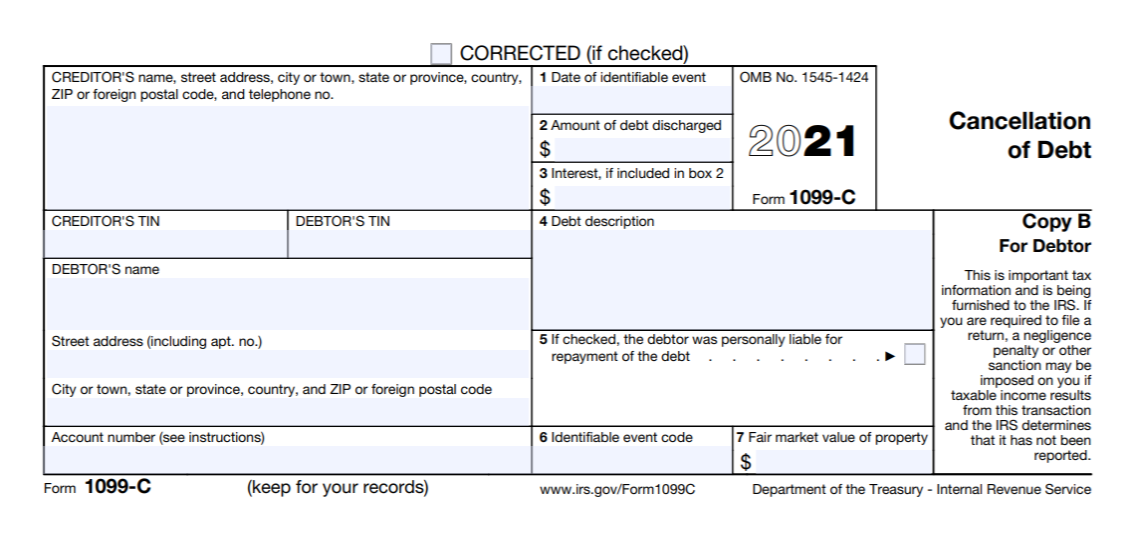

It turns out that she should have been filing her taxes all of these years. If she was just receiving her social security, she would not have been required to file but since she was receiving the pension that totaled $24,000 for the year on top of that the social security had become taxable.

To make matters worse she had no withholdings set up on the social security or the pension.

After a few years of not filing these taxes, the IRS had begun filing missing years on her behalf. They had completed 3 substitutes for returns and still had 5 years that were unfiled that the IRS was looking for.

At this point the IRS had her owing a little over $37,000 for the three years filed with penalties, fees and interest. They had been garnishing her social security check for almost the whole past year and had taken a total of $2700 from her. The bad thing was that all of this had gone directly to penalties and interest.

The Resolution

The first step in her case would be to get her compliant with her filing requirements.

Our Enrolled Agents were able to convince the IRS to allow a temporary hold on the garnishment while we filed these years. Typically, the IRS will never release a garnishment, so this was definitely a gift.

We filed these years and because of the lack of the lack of withholdings she owed a significant amount more. The IRS took a few months to assess these filings, but they kept that hold on the garnishment while they did this. Once the filings were all assessed Ms. J owed about $70,000 altogether.

At first, she was horrified to be owing this much. She had gone from a few months ago thinking that she was not required to file head on into a major situation with the IRS.

At this point we already had a plan in place of how we were going to help her resolve her tax debt. Since she was now compliant with her filings, she had a lot of rights when it comes to owing the tax debt.

The next step was proving her ability to pay the debt back.

The first thing that needed to be done is that she had to fix her withholdings with her social security and the pension that she had. This would do two things.

First of all, it would stop her from owing any further tax debt. The programs that company of our nature utilize have a lot of benefits and savings, so they are one time get of debt programs. Also, present year tax debt is an expense that she has a right to pay prior to paying back taxes so paying these taxes first will lower her payment on the older debt.

After this we were able to show all other allowable expenses, and this gave us the ability to negotiate a very small payment for her. She would only be required to pay $25 a month. Since the is a statute of limitations on tax debt she will only end up paying back around $3000 on the $70,0000 that she owes.

Ms. J was very excited to say the least. She came to us not having a clue what was happening or how she could possibly owe the IRS and now she had an end date to everything.

Also, the garnishment was released and she was paying her very small payment that helped her afford all of her other allowable expenses. If you have not filed taxes out of fear that you will owe the IRS money that you don’t have, contact us for a free tax consultation.

Let’s see how we can help you resolve your situation so you can stop worrying about the IRS.