This is a question that comes up a lot with clients that work outside of the country either during portions of the year or are full-time residents of other countries. Estimates suggest that there are around 8 million US citizens living in other countries around the world.

Some American citizens are there for employment and financial reasons, others are retired, while some may be born in these foreign countries, but they are the children of US citizens. All these people are most likely required to file a US tax return every year.

The United States tax system is incredibly unique in that it is a citizenship-based tax system. With this system, it does not matter where in the world you live, if you are a US citizen you are required to file taxes by June 15th of each year. There are tax treaties in place with some countries so many citizens living abroad file their taxes and owe nothing.

Whether you owe taxes or not all US citizens are required to file their tax returns if they have earned income over the minimum thresholds. With others that are living in foreign countries, they find themselves in a situation of double taxation. This is when you must pay taxes in the US because of your citizenship, and you are also required to pay taxes in the country where they are living.

Foreign Earned Income Exclusion

This article will discuss a remedy to the possibility of double taxation. A lot of these taxpayers may qualify for the Foreign Earned Income Exclusion. This is where a portion of your foreign earned income can be excluded from US taxation.

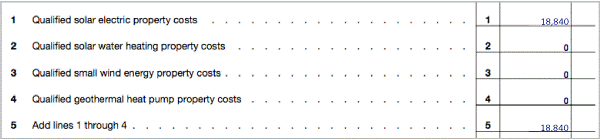

In 2020 the allowable exclusion cannot be more than the smaller of the following:

- $107,600 for Single filers or if Married Filing Jointly it can be $107,600 for each spouse if they both qualify and meet the requirements.

- Foreign earned income for the tax year minus the amount of foreign housing exclusion or housing deduction if taken.

How Do I Qualify?

This exclusion is the most common and widely used tax benefit for US citizens living abroad. It allows Americans to exclude all or a portion of their foreign earned income from their US taxes. With such great benefit, this is not a blanket exclusion for all foreign earned income. There are some specific qualifiers that you must meet.

The requirements to file minimum income thresholds are the same as for US residents. For Tax year 2020 the thresholds for total yearly income as laid out below as seen on the American Citizens Abroad website.

| Marital Status | Under 65 | 65 or Older |

|---|---|---|

| You are single (unmarried) | $12,400 | $14,050 |

| You are married filing jointly | $24,800 | $27,400 (both over 65) |

| You are married filing separately | $5 | $5 |

| You are filing as “Head of household” | $18,650 | $20,300 |

| You are a widow or widower | $24,800 | $26,100 |

Foreign earned income means wages, salaries, professional fees, or other amounts paid to you for personal services rendered by you. It does not include amounts received for personal services provided to a corporation that represent a distribution of earnings and profits rather than reasonable compensation.

A qualifying individual may claim the foreign earned income exclusion on foreign earned self-employment income. The excluded amount will reduce your regular income tax but will not reduce your self-employment tax.

There are some forms of income that do not qualify for the exclusion such as:

- Pay received as a military or civilian employee of the US government or any of its agencies.

- Pay for services conducted in international water or airspace (not a foreign country)

- Payments received after the end of the tax year following the year in which the services that earned the income were performed.

- Pay otherwise excludable from income, such as the value of meals and lodging furnished for the convenience of your employer on the premises.

- Pension or annuity payments including social security benefits

To claim the foreign earned income exclusion a taxpayer must meet all three of the following requirements:

- Their tax home must be in a foreign country. A tax home is a place where a taxpayer permanently or indefinitely engages to work as an employee or self-employed individual. A tax home is not in a foreign country for any period in which a taxpayer’s abode is in the United States. An abode is one’s home, habitation, residence, domicile, or place of dwelling.

- The Taxpayer must have foreign earned income.

- The Taxpayer must meet either the Bona Fide Residence Test or the Physical Presence Test.

Bona Fide Resident Test

A taxpayer does not automatically acquire bone fide resident’s status merely by living in a foreign country for one year. The length of the stay and nature of the job are additional factors that determine whether a taxpayer meets the test.

A taxpayer who travels to a foreign country to work on a particular construction job for a specified period of time ordinarily is not a bona fide resident of that country even if working there for more than one tax year.

To be a bona fide resident a taxpayer must be:

A US citizen who is a resident of a freeing country or country for an uninterrupted period that includes an entire tax year.

or

A US resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or country for an uninterrupted period that includes an entire tax year.

Physical Presence Test

A US citizen or a US resident alien physically present in a foreign country or country for at least 330 full days during any period of 12 consecutive months.

The physical presence test is based only on how long the taxpayer is in a foreign country. The test does not depend on the kind of residence established, intentions about returning, or the nature and purpose of the stay abroad.

How to File for the Foreign Earned Income Exclusion?

If you qualify for the foreign earned income exclusion, then you must submit a Form 2555 with your Form 1040 or 1040x. Do not submit this form by itself. Form 2555 shows how you qualify for the bona fide residence test or the physical presence test, how much of your foreign earned income is excluded and how to figure out the amount of your allowable foreign housing exclusion or deduction.

If you and your spouse both qualify to claim the foreign earned income exclusion, the foreign housing exclusion, or the foreign housing deduction, you and your spouse must file separate 2555 Forms to claim these benefits.

What if I do not qualify for the Foreign Earned Income Exclusion?

If you do not meet these requirements for the exclusion, it is not the end of the road. It does not mean you will have to pay tax on all your income.

Another option is the Foreign Tax Credit. The foreign tax credit is a non-refundable tax credit for income taxes paid to a foreign government because of foreign income tax withholdings. The foreign tax credit is available to anyone who either works in a foreign country or has investment income from a foreign source. Generally, only income, war profits, and excess profit taxes qualify for this credit. You can not claim the foreign tax credit on the same income.

Another option for a US citizen living abroad is the Foreign Housing Exclusion. This deduction was created by the IRS to offset the expenses that go hand in hand with living overseas, this exclusion decreases a taxpayer’s tax liability by allowing certain housing expenses to be deducted from taxable income. This exclusion can be used if your housing costs were over 16% of the FEIE amount for that year. If you live in a city that is identified by the IRS as ultra-high cost, you may be able to use an additional amount for the foreign housing exclusion.

In conclusion, if you had not realized that as a citizen you are still required to file a Federal Tax Return it is not too late to take advantage of the exclusion if you qualify. To take this exclusion you generally must file within one year of the due date of your return or by amending a timely filed return. However, if the IRS has not discovered your failure to file or if you owe no tax after taking the exclusion you may still be able to exclude your foreign earned income from your US taxes.

As we have recommended in many other articles, any time you are dealing with these more complex filings it is smart to hire a true tax professional who has the education and licensing to take advantage of everything within tax law that can save you money. In a situation like this, an Enrolled Agent or a CPA is a trusted source that you can turn to.