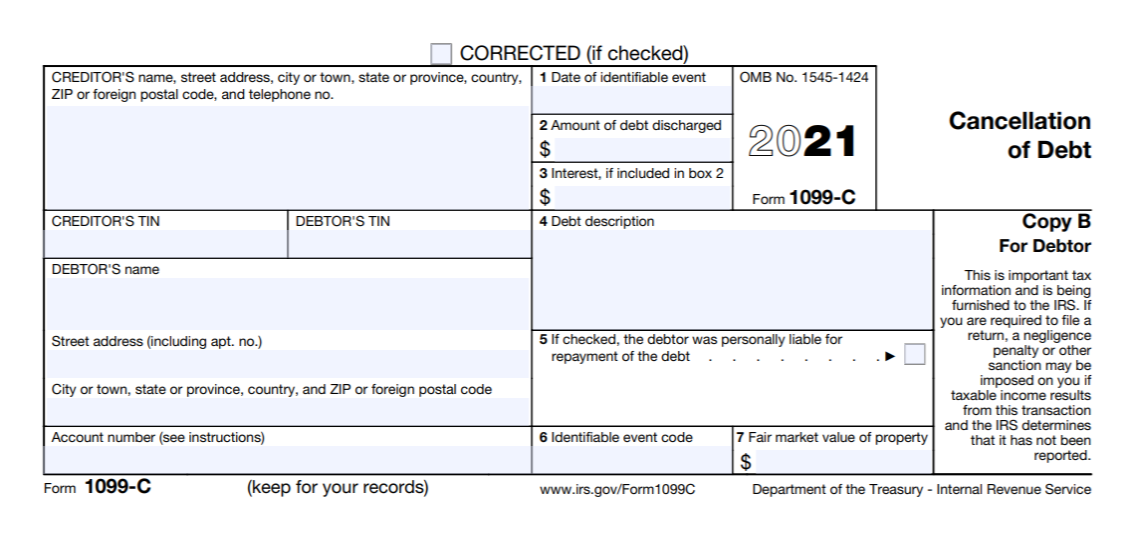

If your debt has become too overwhelming for you to repay, you could contact your lender and negotiate debt forgiveness. Unfortunately, you will probably be called to deal with a huge tax bill if the lender eventually decides to delete your debt and send you a Form 1099-C. This is because you are required by law to report the sum to the IRS by filling out the 1099-C form as taxable income.

We will give you all the details you need to know about a 1099-C Cancellation of Debt so you have an idea of what is involved and how to deal with any tax issues that may come along.

What Is a 1099-C?

If you can no longer afford to pay off a loan or another debt and you have, somehow, managed to get your lender to cancel or write off your debt, the IRS will consider it income for you. Cancellations for more than $600 should be reported on a Form 1099-C Cancellation of Debt. Of course, some exceptions apply, usually in cases of foreclosed homes and bankruptcy (we will also talk about these in a subsequent section).

Yes, it probably sounds unfair that a debt you have successfully negotiated away or canceled to return as taxable income, haunting your days. Sadly, it is, indeed, classified as income because the IRS sees it as you receiving a benefit without paying for it. This is because when you first borrowed money from the lender, you were bound by a contract to repay it. Therefore, you were not obliged to pay tax on the sum you got. Now that you got yourself a debt cancellation, the contract is no longer in effect, which means that you can do whatever you want with the money you borrowed. So, it looks like you have received money for free – money that you must pay back. This makes it taxable income.

You can receive a Form 1099-C from a lender that discharged, forgave, or canceled your debt for the:

- Modification of a loan on your principal residence.

- Abandonment of property.

- Return of property to a lender.

- Foreclosure

- Repossession

What Is the 1099-C Tax Rate?

The amount of federal tax you will be asked to pay depends on several factors, such as your tax bracket. Taxpayers whose income is less than $35,000 are probably in the 15% tax bracket, which means that you pay 15% of every extra dollar of income on your return. This sum climbs to around $70,000 for married individuals filing jointly. However, your adjusted gross income affects things like phase-out ranges, deductions, and credits you might have.

You may use the IRS Withholding Calculator to estimate the right amount of tax withheld and the best way to fill out your Form W-4. Or, you can ask an accountant for assistance. Note that any tax liability occurs when the loan obligation is released and not when 1099-C is issued. Failing to report this liability can lead you to be penalized for it (25% underreporting penalty). At the same time, your audit period increases from three to six years. That being said, though, the IRS will not impose penalties for underpayment of tax. The only exception is if you owe more than $1,000 when your return is filed.

Where Does a 1099-C Go On a Tax Return?

You must enter the total sum of your 1099-C on Line 21 of Form 1040. This applies to 1099-C issued for a personal debt (Form 1040 is the Individual Income Tax Return form). If this is about a farm or business debt, you need to use either Schedule F or Schedule C (profit or loss from farming or business). Given that the original 1099-C has gone to the IRS, you do not need to send a copy of it with your return. Just don’t forget to include any interest you may qualify to deduct.

Now, if you do not file a return that includes canceled debt as income on a 1099-C form, you must be able to prove that the sum is not taxable. This can be done by:

- Attaching a statement of liabilities & assets or bankruptcy discharge forms to support your claim (in case of bankruptcy).

- Complete a Form 982.

- Attach a letter to your return explaining your situation in detail (i.e., insolvency or bankruptcy).

What’s the Difference Between a 1099-A and 1099-C?

Selling real estate comes with various tax forms that need to be filed, including 1099-A and 1099-C, which create a lot of confusion for everybody involved. Let’s help untangle this knot.

When real estate property is either transferred or sold, you must notify the IRS using Form 1099-S (Proceeds From Real Estate Transactions). The seller receives this form to report the sale and help show whether there is a loss or gain on the property sale. The seller also receives this form in a deed of lieu of foreclosure and short sale. Nevertheless, when dealing with a foreclosure, the sale is involuntary, which is why no 1099-S is issued to determine whether there is loss or gain on the property sale. Instead, you (the seller) must report the property transfer via a 1099-A (Acquisition or Abandonment of Secured Property), which reports things like the:

- Balance of principal outstanding on the transfer date.

- Fair market value on the transfer date.

- Date of the transfer.

Note that selling a property in a foreclosure auction is NOT always tied to zero capital gain. In certain situations, adjustments to cost basis may lead to a capital gain on such property sales, which may result in added tax liability that you might be unable to pay.

Now, if a lender cancels or forgives a debt, be it a foreclosure, deed in lieu of foreclosure, or a short sale, it may involve the issuance of a 1099-C to report the cancellation of debt. Beware as the tax consequences are exactly the same for the cancellation of debt income, irrespective of where it is generated from (I.e., a foreclosure, deed in lieu of foreclosure, or short sale), as long as the forgiven debt is $600 or more. Certain exclusions apply that can eliminate or reduce the 1099-C sum from taxable income, such as:

- Relief pursuant to the Mortgage Forgiveness Debt Relief Act – if the seller qualifies for it.

- Insolvency of the seller before having their debt canceled or forgiven.

- Discharge of the debt in bankruptcy.

Do not hesitate to use our expertise and experienced tax professionals to help report these transactions on your tax return correctly.

You May Be Able to Avoid Paying Tax on Canceled Debt

You may qualify for one of the many exclusions that enable you to reduce your taxable income from debts that have been forgiven or canceled. Here are some of the most sweeping ones:

- Debts canceled when you were broke (IRS refers to this as being insolvent). It applies to the sum by which you are insolvent.

- Discharged debts in bankruptcy if you filed for bankruptcy protection.

- Forgiven student loans after having worked for a period of time.

- Canceled interest that would have been otherwise deductible (i.e., on business debt).

- The debt was canceled as a gift (usually from friends or family members).

- Farm and business real estate-related debt that was canceled when you owned more than how much your property was worth at that time.

It is paramount to let an experienced tax preparer handle this type of activity for you. If any of these exclusions apply to your case, you will probably need to file a Form 982 on top of the 1099-C.

The Mortgage Forgiveness Debt Relief Act

The Mortgage Forgiveness Debt Relief Act (MFDRA) was passed in 2007 in an attempt to tackle the huge collapse of the real estate market that began in 2007. Congress decided that you may exclude up to $2 million for calendar years 2007 through 2020. This applies exclusively to forgiven mortgage debt, of course. The sum mentioned above relates to married individuals filing jointly. For other filing statuses, the amount that can be excluded is no more than $1 million.

Note that you may benefit from the MFDRA for debt that was discharged in 2021. The only prerequisite is that you enter into a written agreement in 2020. This exclusion also covers mortgage debt that has been canceled in connection with a foreclosure or via a mortgage restructuring.

Avoiding Tax Debt After Insolvency and Bankruptcy

You might still be able to avoid taxation in case you have had your debt canceled, even if you receive a Form 1099-C if your debt was discharged in a Chapter 13, Chapter 7, or another Title 11 bankruptcy proceeding. This means that if your case falls under this category, you won’t have to pay taxes for your forgiven debt.

Similarly, you can avoid taxes on canceled debt if you can show the IRS that you were broke (insolvent) when your debt was forgiven.

Are you eligible for tax debt relief? Can you reduce or even eliminate your tax obligations after a 1099-C is issued to you? Give us a call or contact us for a free tax consultation and let’s discuss your options so that you can finally be relieved of your tax problems.