Offer in Compromise is an IRS program that enables taxpayers to get a fresh start with the Internal Revenue Service. In doing so, they have the chance to settle their tax debt for less than the overall amount of money they owe. Therefore, if you are struggling to pay your federal or state tax debt, this could be a useful program to consider. In 2018 alone, the IRS accepted around 24,000 offers (up 24% from 2010) while rejecting just as many.

So, how can you determine if Offer in Compromise (OIC) is an initiative that could solve your tax issues? How can you get an offer accepted? How much should you offer to the IRS? We give you all the necessary details and answer these concerns below.

How Much Should I Offer in Compromise to the IRS?

This is perhaps one of the most challenging parts of submitting an Offer in Compromise. On the one hand, you don’t want to come forward with an unrealistically low offer that could ruin your acceptance chances. On the other hand, you do aspire to pay as little as possible to the IRS so that you can finally settle your tax debt. Given that each case is different, there is really no magic formula. In fact, it requires a lot of experience to be able to recognize when an offer is too low.

That being said, there ARE some ways to get some idea of how much is probably enough when you make an Offer in Compromise. Let’s start with the basics – the bare minimum offer sum. Note that it will NOT guarantee that your offer gets accepted by the IRS. It will, however, give some confidence that your offer is in the right ballpark.

What the IRS is primarily focused on is to receive offers of at least the same amount of the taxpayer’s Reasonable Collection Potential (RCP). This is a number the IRS uses to determine your ability to pay the owed taxes, and takes into consideration several liabilities, such as your:

- Assets

- Monthly living expenses

- Monthly income

So, generally speaking, you can begin with an estimate of 12 months’ worth of your disposable income. Then, calculate any additional cash you can get from selling valuable assets and submit an offer with an amount higher than your RCP. This is critical, especially if you are planning on submitting an Offer in Compromise on the basis that you are unable to pay the due tax (as opposed to Effective Tax Administration or Doubt as to Liability).

The problem lies in calculating your Reasonable Collection Potential. Here are some steps to follow:

- Estimate the income you have from all sources within a month and then subtract the full sum that corresponds to your living expenses (the necessary ones only, such as car payment, groceries, utilities, rent, etc.). The number you will get is your monthly disposable income.

- Multiply your monthly disposable income by 12 to get your annual disposable income.

- Add to that amount any assets that you could sell, such as valuable collectibles, investments, and an extra car. At this point, note that determining how much these assets are worth is a point of negotiation with the IRS for many taxpayers.

The result of these calculations will give you the bare minimum you can offer.

Should You Pay Installments or All At Once?

Many taxpayers wonder if they should pay the offer amount in installments rather than with one lump sum payment. Although the IRS enables monthly payments for this purpose, it is best to pay the offer in fewer than five monthly installments if it is possible. This is because the IRS will use 24 months of your disposable income for anything beyond five installments to calculate your Reasonable Collection Potential (with five or fewer installments, they will use 12 months of your RCP). If that happens, the amount the IRS will want from you will essentially double.

How To Get An Offer in Compromise Approved

As already mentioned, the IRS is highly likely to turn down offers that do not meet (even better, exceed) the taxpayer’s RCP. That being said, some factors play a leading role in making an Offer in Compromise quicker. These include:

- Low Income W2 Earnings – You make less than $30,000 annually, and your only income source is a wage-earning job.

- Fixed Retirement Income – You are a 55+ years of age retiree and receive a fixed income.

- Social Security/ Disability Income – You only get a Disability or Social Security income.

Some factors, on the other hand, can contribute to longer-than-average decisions about your Offer in Compromise, such as:

- High Balance – Offers with balances $25,000+ usually take much longer to process than those with lower balances.

- Self-Employment – The IRS conducts in-depth research on your expenses, making sure you don’t mix your personal and business expenses.

- Initial Rejection – If you have already submitted an offer that got rejected and want to have it reevaluated, you could be adding up to six more months to the overall procedure.

- Other Circumstances – If you own multiple vehicles, have lots of loans, or many different deposits all over the place, you will need to do some explaining to the IRS. This pushes the process further back in time.

So, is everything lost? Not at all. You can still boost the Offer in Compromise process by doing the following:

- Ensure you have all the necessary details – The IRS will request things like bank statements. Check that the ones you submit have all the pages, even those that you may find useless (i.e., a blank page). Then, send your Offer.

- Provide good explanations – If your financials, for some reason, does not look right, make sure that you give a sound reason for it in the cover letter.

- Reply fast and accurately – It is paramount that you respond to IRS requests for further clarification as timely as you can. The information you provide should also be accurate.

- Propose the presumed maximum amount of money – The IRS expects to collect some money from you within a reasonable time period. Offering them the max sum of the presumed amount will most likely get your offer approved

To get there, ensure that you have filed all tax returns, made the required estimated tax payment for the current year, and include a bill of one or more tax debt in your offer. Business owners with employees must have made the needed federal tax deposits for the current quarter.

Besides what is reported to Form 433-A, the IRS will investigate several other factors, such as your level of education, age, asset equity, expenses, income, Collection Statute Expiration Date, and, of course, your lifestyle. If something about the way you live is contradictory to the fact that you are unable to pay your taxes, the IRS may reject your offer.

How Can I Submit An Offer In Compromise Application?

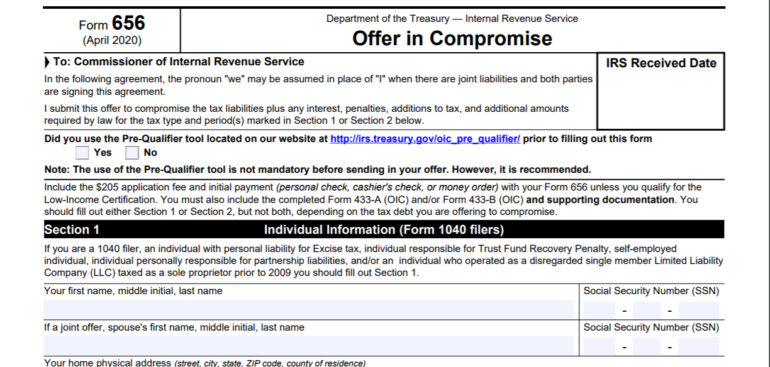

To apply for an Offer in Compromise, you will need the following Offer in Compromise Forms:

- Form 656 – You need this to make your offer.

- Form 433-A – This Collection Information Statement for Wage Earners and Self-Employed Individuals helps the IRS determine whether you are facing financial strain and to what extent.

- Form 433-B – This is the same as with Form 433-A with the difference that it is a Collection Information Statement for Businesses. It serves the exact same purpose as Form 433-A.

Common Mistakes to Avoid when Filling out your OIC Application

The IRS will get all the information they need about your financial situation from Form 433-A (see above). It is, therefore, crucial that you ensure you don’t make any math errors on that form, although the form indeed requires a considerable amount of complex calculations. You certainly don’t want to put your OIC process to a halt to have incorrect calculations sorted out.

Other mistakes on OIC forms we usually see and either cause confusion or have a dramatic impact on a case are as follows:

- Leaving empty/blank spaces – Never leave a field on a 433 or 656 empty. It is best to write “N/A” in these spaces.

- Writing negative equity – It is essential that any negative equity is reported as zero. Many tax accountants subtract the negative equity from the taxpayer’s NRE (Net Realizable Equity) when the taxpayer’s asset (property, in this case) is worth less than they owe on it, which is wrong.

How Long Does It Take To Get a Response From the IRS?

Although there are no set timelines for exactly how long it will take the IRS to decide whether to reject or approve an Offer in Compromise, our experience has shown that it usually requires between 4-9 months. However, some more complex Offers in Compromise may need much more time to get resolved, which could reach 48 months from the day the OIC process was completed, which usually takes roughly 6 months. The most common factors that could drag a response from the IRS are related to self-employment. Regardless, the IRS does respond within two years.

If the IRS accepts your offer, you need to stick to your part of the deal and pay the agreed sums. Now, if your offer gets rejected, know that you can file an appeal via Form 13711 (hence, renegotiate your OIC under more favorable terms) within 30 days of the rejection notice date.

Is an Offer In Compromise the Best Option for You?

Although an Offer in Compromise is an excellent collection solution, it is not the only option you could consider. To determine that, you will need to have a trusted tax professional evaluate your tax situation, the IRS collection alternatives, and your personal finances as a means to develop the optimal approach to repay your debt. Don’t hesitate to call or contact us for a free tax consultation to see how we can help you get out of debt as painlessly and swiftly as possible while negotiating the best terms for you.